Trident Protocol

Smart Contract Audit Report

Audit Summary

Trident Protocol is a new BEP-20 token on the Binance Smart Chain with an elastic supply that performs automatic liquidity adds.

Trident Protocol is a new BEP-20 token on the Binance Smart Chain with an elastic supply that performs automatic liquidity adds.

For this audit, we reviewed the project team's Trident contract at 0x2ED3eb8Bb9bdBC7C837AA113413425a6a7AF26d7 on the Binance Smart Chain Mainnet.

Audit Findings

Low findings were identified and the team should consider resolving these issues. In addition, centralized aspects are present.

Date: August 17th, 2022.Finding #1 - Trident - Low

Description: In the rebase() function, the second "if" condition will always be true after one year. As a result of this, the last two conditions will never be reached.

Risk/Impact: The rebase rate will permanently remain the same after one year.function rebase() internal { ... if (deltaTimeFromInit < (365 days)) { rebaseRate = 2355; } else if (deltaTimeFromInit >= (365 days)) { rebaseRate = 211; } else if (deltaTimeFromInit >= ((15 * 365 days) / 10)) { rebaseRate = 14; } else if (deltaTimeFromInit >= (7 * 365 days)) { rebaseRate = 2; }

Recommendation: The "if" conditions should be re-ordered to fit the project team's intended functionality.

Resolution: The team has not yet addressed this issue.

Finding #2 - Trident - Informational

Description: There are four instances in the takeFee() function where multiplication is performed on the result of a division. Division can lead to integer truncation, therefore dividing and subsequently multiplying can cause results to lose precision and become less accurate.

Recommendation: We recommend modifying these calculations to perform all multiplication before division.uint256 feeAmount = gonAmount.div(feeDenominator).mul(_totalFee); _gonBalances[blackHole] = _gonBalances[blackHole].add( gonAmount.div(feeDenominator).mul(blackHoleFee) ); _gonBalances[address(this)] = _gonBalances[address(this)].add( gonAmount.div(feeDenominator).mul(_treasuryFee.add(tridentInsuranceFundFee)) ); _gonBalances[autoLiquidityReceiver] = _gonBalances[autoLiquidityReceiver].add( gonAmount.div(feeDenominator).mul(liquidityFee) );

Finding #3 - Trident - Informational

Description: Several state variables cannot be modified but are not declared constant.

Recommendation: These state variables could be declared constant for additional gas savings on each reference.DEAD, ZERO, _decimals, _name, _symbol, blackHoleFee, feeDenominator, liquidityFee, sellFee, treasuryFee, tridentInsuranceFundFee

Finding #4 - Trident - Informational

Description: TheswapEnabledstate variable is not used in the contract.

Recommendation: This state variable could be removed to reduce contract size and deployment costs.

Contract Overview

- The initial supply of the token is set to 325,000 $TRIDENT.

- The maximum supply of the token is 3.25 billion [3,250,000,000].

- No mint or burn functions are present, though the circulating supply can be reduced by sending tokens to the 0x..dead address.

- At the time of writing this report, 100% of the total supply belongs to the owner.

- There is a Liquidity fee, Treasury fee, Insurance Fund fee, and a Blackhole fee on all transfers via Pancakeswap where neither the sender nor the recipient is excluded from fees.

- There is an additional Sell fee added on all sell transactions via Pancakeswap.

- Blacklisted contracts are not permitted to transfer tokens.

- The contract features an auto-rebase mechanism that is triggered on token transfers when the following conditions are met:

- The auto-rebase mechanism is enabled by the team.

- The token has not reached the maximum supply.

- The caller is not initiating a buy transaction via Pancakeswap.

- The contract is not currently swapping tokens, performing a rebase, or performing an automatic liquidity add.

- 15 minutes have passed since this functionality has previously occurred.

- During a rebase, tokens are automatically added to the total supply. The newly added tokens are distributed proportionally amongst holders in a frictionless manner.

- The number of tokens added to the total supply is dependent on the total supply at the time of rebasing and the time since deployment.

- The rebase function properly calls sync() on the Pair addresses to prevent theft-of-liquidity attacks that have occurred with other rebase tokens.

- Also during transfers, an automatic liquidity add will occur if at least 2 days have passed since the previous automatic liquidity add.

- A liquidity-add is funded by selling half of the tokens collected as liquidity fees, pairing the received BNB with the token, and adding it as liquidity to the BNB pair.

- The LP tokens received through this process are sent to the Liquidity address set by the team. We recommend the team lock the newly acquired LP tokens.

- The tokens collected through the Treasury fee and Insurance Fund fee are swapped for BNB and sent to the team's Treasury wallet and Insurance Fund wallet respectively.

- The tokens collected through the Blackhole Fee are sent to the Blackhole address set by the team.

- The contract complies with the BEP-20 token standard.

- The contract utilizes SafeMath libraries to protect against overflows/underflows.

- The owner can enable/disable automatic liquidity adds and the auto-rebase mechanism at any time.

- The owner can add/remove any contract address from the transfer blacklist at any time. EOAs cannot be blacklisted.

- The owner can include/exclude accounts from transfer fees at any time.

- The owner can swap all of the $TRIDENT in the contract for BNB and send it to the team's Treasury wallet at any time.

- The owner can update the Automated Market Maker Pair address, Liquidity wallet, Treasury wallet, Insurance Fund wallet, and Blackhole wallet to any addresses at any time.

Audit Results

| Vulnerability Category | Notes | Result |

|---|---|---|

| Arbitrary Jump/Storage Write | N/A | PASS |

| Centralization of Control |

|

WARNING |

| Compiler Issues | N/A | PASS |

| Delegate Call to Untrusted Contract | N/A | PASS |

| Dependence on Predictable Variables | N/A | PASS |

| Ether/Token Theft | N/A | PASS |

| Flash Loans | N/A | PASS |

| Front Running | N/A | PASS |

| Improper Events | N/A | PASS |

| Improper Authorization Scheme | N/A | PASS |

| Integer Over/Underflow | N/A | PASS |

| Logical Issues | N/A | PASS |

| Oracle Issues | N/A | PASS |

| Outdated Compiler Version | N/A | PASS |

| Race Conditions | N/A | PASS |

| Reentrancy | N/A | PASS |

| Signature Issues | N/A | PASS |

| Unbounded Loops | N/A | PASS |

| Unused Code | The swapEnabled state variable is not used in the contract. | PASS |

| Overall Contract Safety | PASS |

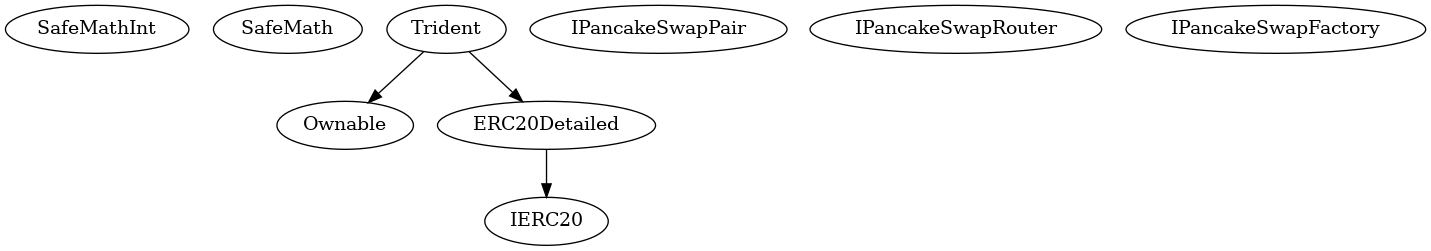

Inheritance Chart

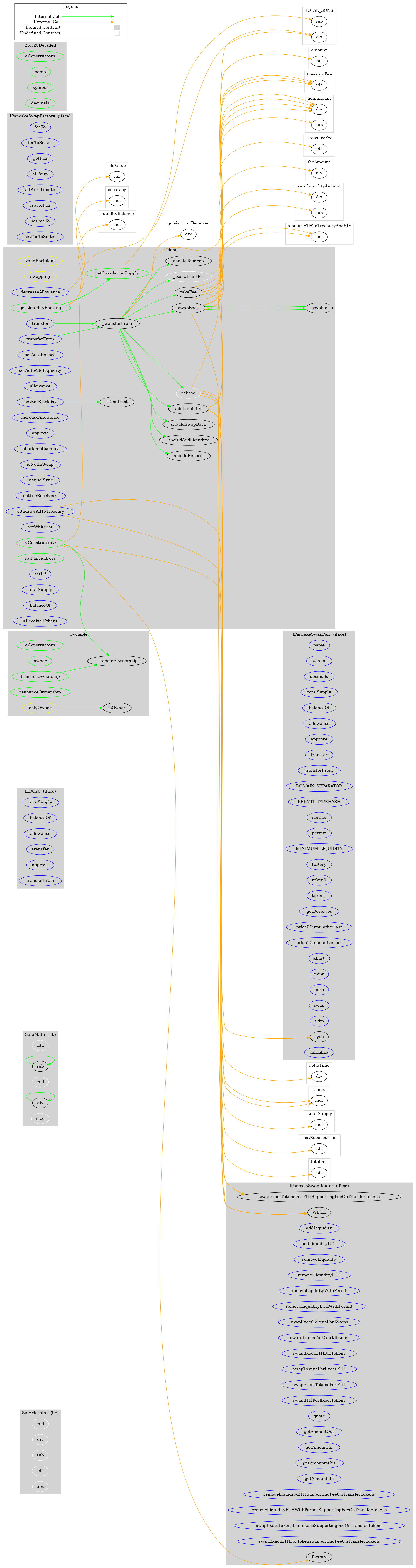

Function Graph

Functions Overview

($) = payable function

# = non-constant function

Int = Internal

Ext = External

Pub = Public

+ [Lib] SafeMathInt

- [Int] mul

- [Int] div

- [Int] sub

- [Int] add

- [Int] abs

+ [Lib] SafeMath

- [Int] add

- [Int] sub

- [Int] sub

- [Int] mul

- [Int] div

- [Int] div

- [Int] mod

+ [Int] IERC20

- [Ext] totalSupply

- [Ext] balanceOf

- [Ext] allowance

- [Ext] transfer #

- [Ext] approve #

- [Ext] transferFrom #

+ [Int] IPancakeSwapPair

- [Ext] name

- [Ext] symbol

- [Ext] decimals

- [Ext] totalSupply

- [Ext] balanceOf

- [Ext] allowance

- [Ext] approve #

- [Ext] transfer #

- [Ext] transferFrom #

- [Ext] DOMAIN_SEPARATOR

- [Ext] PERMIT_TYPEHASH

- [Ext] nonces

- [Ext] permit #

- [Ext] MINIMUM_LIQUIDITY

- [Ext] factory

- [Ext] token0

- [Ext] token1

- [Ext] getReserves

- [Ext] price0CumulativeLast

- [Ext] price1CumulativeLast

- [Ext] kLast

- [Ext] mint #

- [Ext] burn #

- [Ext] swap #

- [Ext] skim #

- [Ext] sync #

- [Ext] initialize #

+ [Int] IPancakeSwapRouter

- [Ext] factory

- [Ext] WETH

- [Ext] addLiquidity #

- [Ext] addLiquidityETH ($)

- [Ext] removeLiquidity #

- [Ext] removeLiquidityETH #

- [Ext] removeLiquidityWithPermit #

- [Ext] removeLiquidityETHWithPermit #

- [Ext] swapExactTokensForTokens #

- [Ext] swapTokensForExactTokens #

- [Ext] swapExactETHForTokens ($)

- [Ext] swapTokensForExactETH #

- [Ext] swapExactTokensForETH #

- [Ext] swapETHForExactTokens ($)

- [Ext] quote

- [Ext] getAmountOut

- [Ext] getAmountIn

- [Ext] getAmountsOut

- [Ext] getAmountsIn

- [Ext] removeLiquidityETHSupportingFeeOnTransferTokens #

- [Ext] removeLiquidityETHWithPermitSupportingFeeOnTransferTokens #

- [Ext] swapExactTokensForTokensSupportingFeeOnTransferTokens #

- [Ext] swapExactETHForTokensSupportingFeeOnTransferTokens ($)

- [Ext] swapExactTokensForETHSupportingFeeOnTransferTokens #

+ [Int] IPancakeSwapFactory

- [Ext] feeTo

- [Ext] feeToSetter

- [Ext] getPair

- [Ext] allPairs

- [Ext] allPairsLength

- [Ext] createPair #

- [Ext] setFeeTo #

- [Ext] setFeeToSetter #

+ Ownable

- [Pub] #

- [Pub] owner

- [Pub] isOwner

- [Pub] renounceOwnership #

- modifiers: onlyOwner

- [Pub] transferOwnership #

- modifiers: onlyOwner

- [Int] _transferOwnership #

+ ERC20Detailed (IERC20)

- [Pub] #

- [Pub] name

- [Pub] symbol

- [Pub] decimals

+ Trident (ERC20Detailed, Ownable)

- [Pub] #

- modifiers: ERC20Detailed,Ownable

- [Int] rebase #

- [Ext] transfer #

- modifiers: validRecipient

- [Ext] transferFrom #

- modifiers: validRecipient

- [Int] _basicTransfer #

- [Int] _transferFrom #

- [Int] takeFee #

- [Int] addLiquidity #

- modifiers: swapping

- [Int] swapBack #

- modifiers: swapping

- [Ext] withdrawAllToTreasury #

- modifiers: swapping,onlyOwner

- [Int] shouldTakeFee

- [Int] shouldRebase

- [Int] shouldAddLiquidity

- [Int] shouldSwapBack

- [Ext] setAutoRebase #

- modifiers: onlyOwner

- [Ext] setAutoAddLiquidity #

- modifiers: onlyOwner

- [Ext] allowance

- [Ext] decreaseAllowance #

- [Ext] increaseAllowance #

- [Ext] approve #

- [Ext] checkFeeExempt

- [Pub] getCirculatingSupply

- [Ext] isNotInSwap

- [Ext] manualSync #

- [Ext] setFeeReceivers #

- modifiers: onlyOwner

- [Pub] getLiquidityBacking

- [Ext] setWhitelist #

- modifiers: onlyOwner

- [Ext] setBotBlacklist #

- modifiers: onlyOwner

- [Pub] setPairAddress #

- modifiers: onlyOwner

- [Ext] setLP #

- modifiers: onlyOwner

- [Ext] totalSupply

- [Ext] balanceOf

- [Int] isContract

- [Ext] ($)

About SourceHat

SourceHat has quickly grown to have one of the most experienced and well-equipped smart contract auditing teams in the industry. Our team has conducted 1300+ solidity smart contract audits covering all major project types and protocols, securing a total of over $50 billion U.S. dollars in on-chain value across 1500 projects!.

Our firm is well-reputed in the community and is trusted as a top smart contract auditing company for the review of solidity code, no matter how complex. Our team of experienced solidity smart contract auditors performs audits for tokens, NFTs, crowdsales, marketplaces, gambling games, financial protocols, and more!

Contact us today to get a free quote for a smart contract audit of your project!

What is a SourceHat Audit?

Typically, a smart contract audit is a comprehensive review process designed to discover logical errors, security vulnerabilities, and optimization opportunities within code. A SourceHat Audit takes this a step further by verifying economic logic to ensure the stability of smart contracts and highlighting privileged functionality to create a report that is easy to understand for developers and community members alike.

How Do I Interpret the Findings?

Each of our Findings will be labeled with a Severity level. We always recommend the team resolve High, Medium, and Low severity findings prior to deploying the code to the mainnet. Here is a breakdown on what each Severity level means for the project:

- High severity indicates that the issue puts a large number of users' funds at risk and has a high probability of exploitation, or the smart contract contains serious logical issues which can prevent the code from operating as intended.

- Medium severity issues are those which place at least some users' funds at risk and has a medium to high probability of exploitation.

- Low severity issues have a relatively minor risk association; these issues have a low probability of occurring or may have a minimal impact.

- Informational issues pose no immediate risk, but inform the project team of opportunities for gas optimizations and following smart contract security best practices.